TD Bank, US

Credit Card Banking Experiences

Sector Fintech, Consumer and Business Banking

Tools Adobe XD, Axure, Figma

Role UI/UX Desktop and Mobile App Design, Prototyping for Usability Testing

As the Lead UX/UI Designer, I drive end-to-end design across TD Bank’s credit card ecosystem, helping customers confidently manage their cards across web and mobile platforms.

My work spans the full cardholder journey—from activating a card and making payments to reviewing transactions, replacing cards, and initiating balance transfers. I focus on simplifying complex financial tasks and reducing friction in high-impact moments, partnering closely with Product, Technology, and Line of Business teams to deliver scalable, accessible, and compliant experiences.

Design

Challenge

Credit card experiences involve complex workflows, regulatory constraints, and high user expectations. My main challenges were to:

Simplify multi-step financial tasks

Reduce cognitive load and abandonment

Create consistent, scalable patterns across platforms

Support Agile delivery while maintaining UX quality

my role & responsibilities

To create an end-to-end UX/UI design from discovery through delivery, I have:

Applied UX best practices for clarity, accessibility, and usability

Created scalable UX patterns and workflows reused across multiple credit card features

Built responsive, accessible UI designs within a design system

Partnered with all stakeholders on solution alignment

Handed off clear design documentation and artifacts to support efficient implementation

UX

Approach

To support scalability and continuous improvement, I focused on:

User-centered workflows grounded in real customer needs

Clear information hierarchy for dense financial data

Consistency across journeys and platforms

Iterative design through MVPs and enhancements

UX PRocess

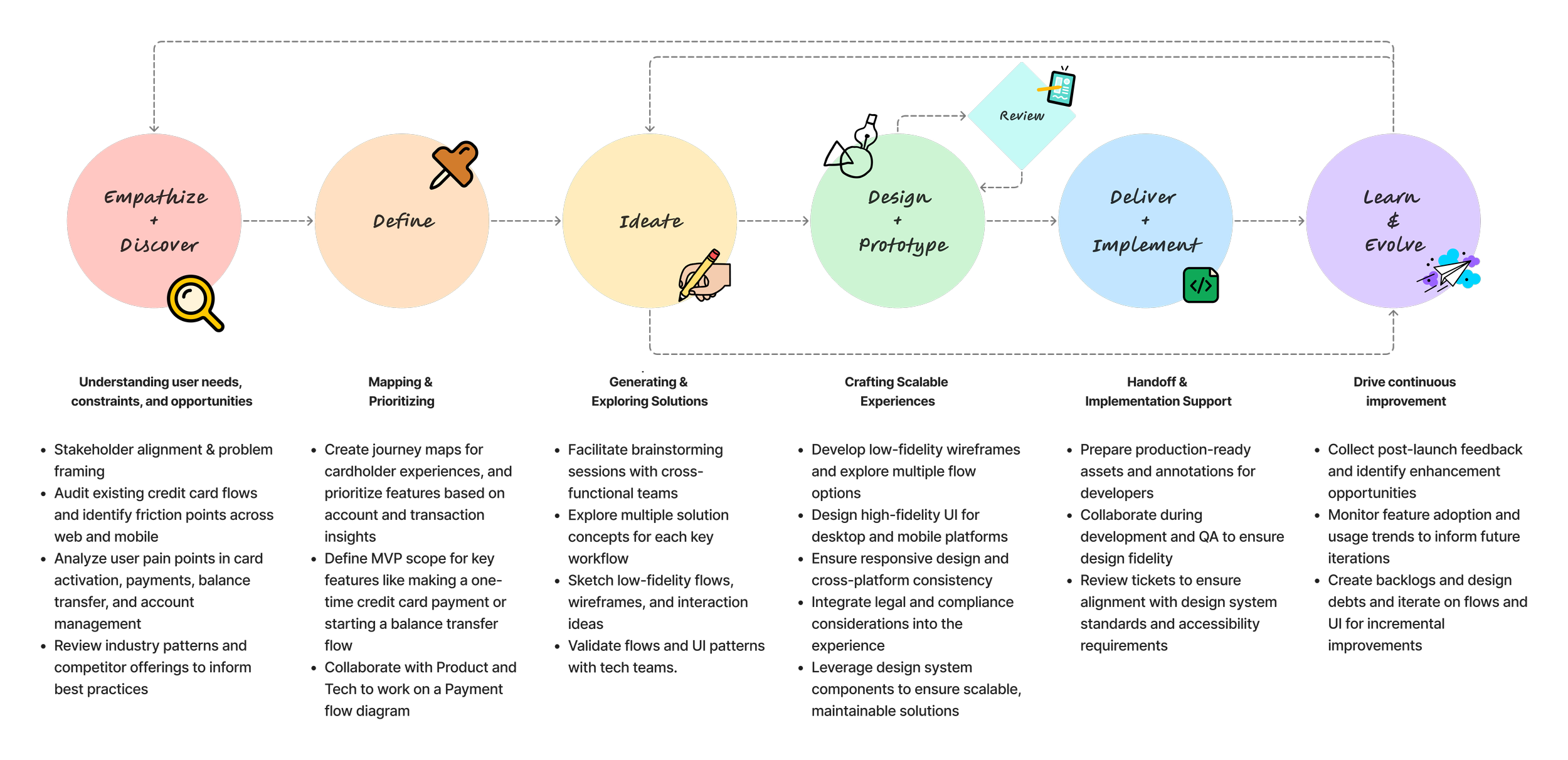

This framework was used flexibly across multiple credit card features that I worked on, scaling depth based on scope and complexity while maintaining a consistent, user-centered approach within an Agile delivery model.

IMPACT

Reduced friction across key credit card journeys by simplifying complex and multi-step workflows.

When a customer is at their high-stress moment, a simple Reason Selector is provided for them to give them direction when their credit card is stolen.

Improved customer usability and comprehension through clearer information hierarchy when making financial decisions.

Optimized the balance transfer flow and created a Balance Transfer Calculator Tool for customers to self-serve and see their savings transparently.

Strengthened customer confidence and trust by designing experiences that are intuitive and transparent in a regulated financial environment.

Delivered a consolidated credit card Payment Center for customers to make a real-time one-time payment or set up an autopay as simple and quick as possible.

For more details

Due to confidentiality, I’m unable to share detailed project specifics publicly, but I’m happy to discuss relevant examples of my work and design process upon request.